If you haven’t heard, most economists are now predicting interest rates are not going to be cut for quite a while. Maybe in the 4th quarter of this year, could be longer. As long as inflation is high, there isn’t much incentive for any rate reductions by the Federal Reserve. Historically rates aren’t bad or abnormally high but there are still a lot of people waiting for mortgage rates to decrease before looking for a new home.

Not long ago, I attended a family & friends gathering. Had a great conversation with a young dad about the real estate market. He and his wife want to buy a home for their new family, but they have been hesitant saying, “We’re just waiting for interest rates to lower.”

What he said made sense, we all want the lowest possible payment and it’s natural to wait until the timing is better (especially for something as big as a home purchase).

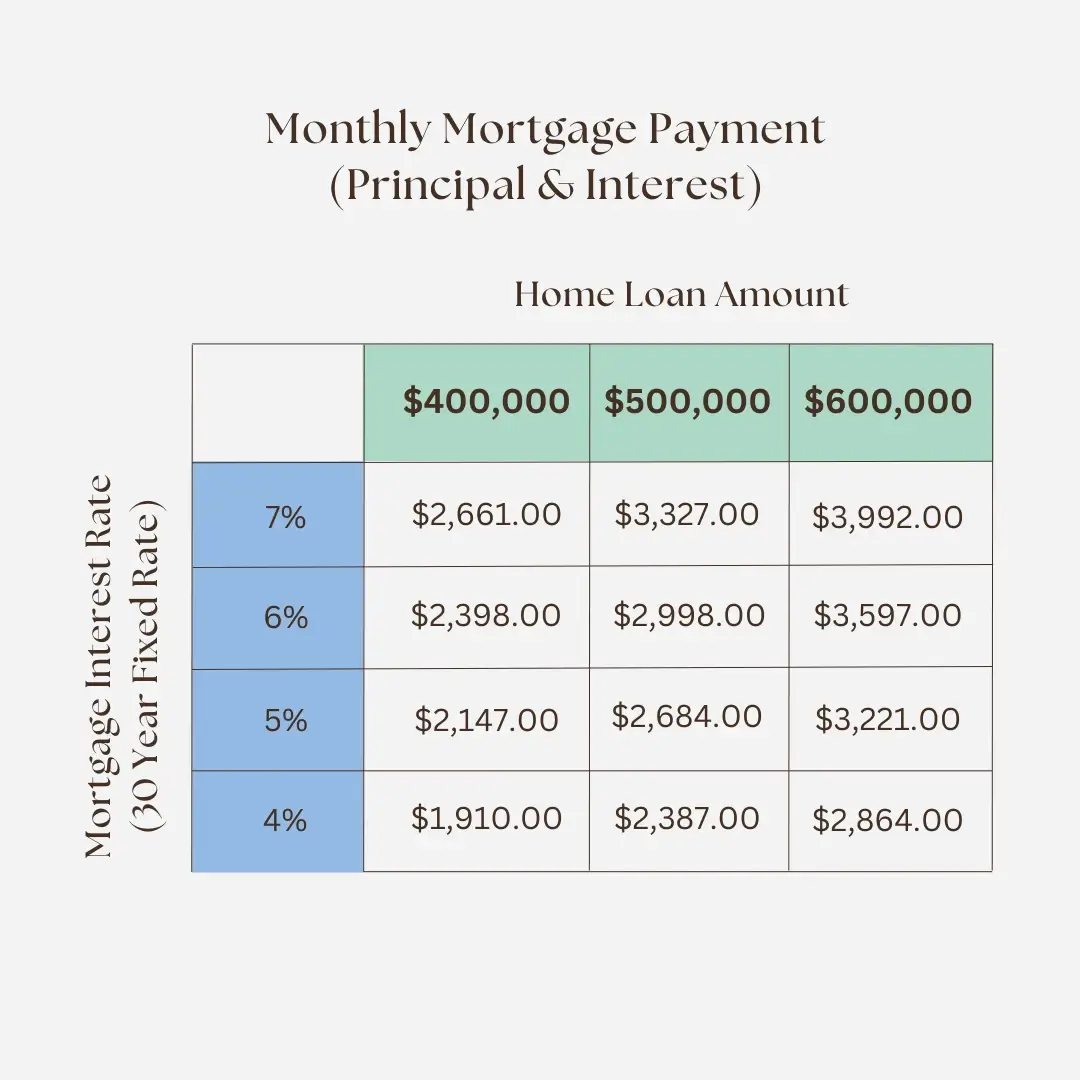

I then posed the question: “What do you think will happen to the real estate market when rates come down?” I explained: “Think about the number of people just like you that are waiting for interest rates to decrease before buying a home. When rates come down there will be a massive influx of new homebuyers making offers on the already shrunken existing home inventory. The law of supply and demand will take over. Multiple offers on any decently priced home will become normal, (just like it was a few years ago). Home prices will increase sharply. The home that you could buy now for $500,000 could increase to $550,000 or even $600,000. Thus, the monthly payment savings that you were counting on because of lower rates could be gone as you have to finance more later to get the same house today.”

There’s a saying in real estate: “Marry the house, Date the rate” meaning finding the best house for you and your family is the most important thing. When rates decrease, refinancing to a lower rate and payment will be an option. You don’t have to wait to start your home ownership dream. Acting now before the market gets hot may be the best choice.

To get started, let’s find out how much you can qualify for now, what the payment would be and how the tax and security benefits of home ownership compares to renting. You may be surprised by the answers.